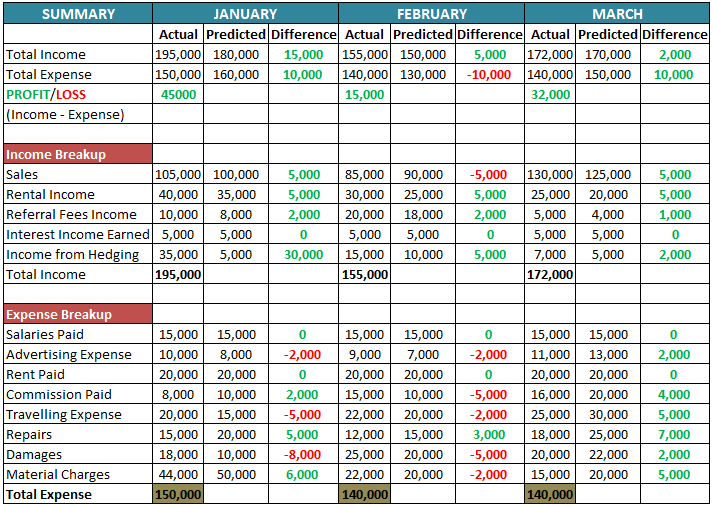

It includes income from sales, interest, etc for a specific period is recorded in this head.

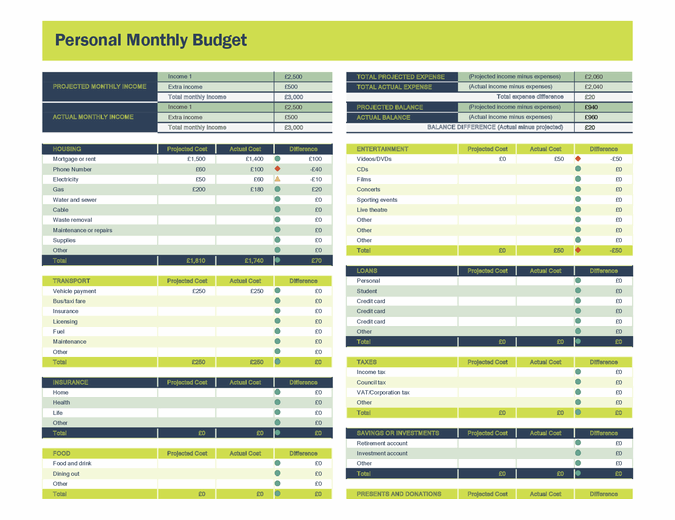

Income Sources: This section record the estimated and Actual Income. Income Sources, Personnel Expenses, Operating Expenses, and Budget Overview. The Header section consists of the Company name and heading of Budget Control. This template consists of three sections: Header Section, Data Input Section, and Charts. Let’s discuss the template contents in detail. Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

#Template budget excel download#

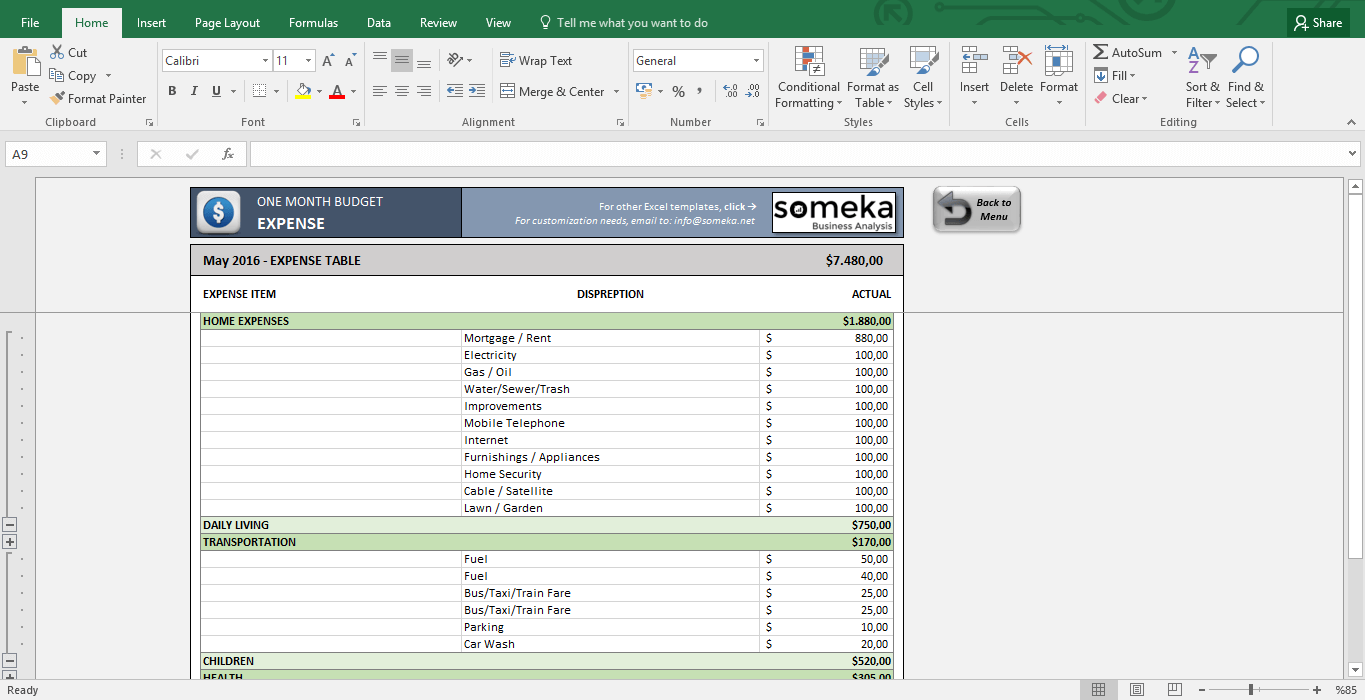

This template will help you manage your finances well and decide financial goals.Ĭlick here to Download All Accounting Excel Templates for ₹299.Īdditionally, you can download other accounting templates like Accounts Payable Template with Aging, Accounts Receivable Template with Aging, and Invoice Excel Templates. We have created a Budget Template with Chart. Budget Template (Excel, Google Sheets, OpenOffice)

Secondly, it includes Personnel expenses such as employee salaries, Employee Benefits Spends, and Commissions. Lastly, it includes all Operating expenses.

In short, the sources from which the company will generate money. It includes Net sales, interest income as well as profit or loss from the sale of assets. The first thing to consider while preparing a budget is to define the sources of income. This allows the management to know whether the budget is surplus, balanced, or deficit. Moreover, the final column depicts the difference between the estimated and actual spending. A budget consists of estimated, and actual figures for the respective heads. Income, Personnel Expenses, and Operating Expenses. Usually, a budget statement includes three components. As the name suggests, a Static Budget is a fixed budget that remains unchanged despite changes in sales or revenue. Hence, the nature of such expenses is static. These include warehousing expenses, cold storage, rents, etc. Some activities of companies are recurring and don’t change much over time. It is a comprehensive overview of the company’s spending against revenues for core operating activities. It depicts a clear picture of the company’s overall financial health. Financial BudgetĪ financial budget represents the strategy of asset management, cash flow, incomes, and expenses. This budget includes accounts payable and accounts receivable. The Cash Flow Budget also helps to take further investment opportunities that can generate future cash flows. It helps the management to know whether the company has ample cash to handle operating activities. It helps the management to use their cash wisely. The purpose of the Cash Flow Budget is to monitor the incoming and outgoing cash of the company. Operating Budgets include costs related to sales, production, labor, material, overhead, manufacturing, and administration. They are helpful to the management to keep an eye on overspending on regular and unnecessary supplies. In some cases, they also make weekly and bi-weekly budgets. Often companies prepare them monthly, quarterly, half-yearly, or yearly. Usually, the management makes the operating budgets time-based. Operating BudgetĬompanies use the Operating Budget to forecast and analyze projected income and expenses over a specific period. This allows the company to establish their financial goals as well as evaluate the overall performance. This budget statement highlights the complete picture of the company’s financial activity.Ī master budget includes factors like sales, operating, assets, income streams, etc. Master Budget, Operating Budget, Cash Flow Budget, Financial Budget, and Static Budget. A budget serves as a plan of action to achieve quantified objectives.Īdditionally, it serves as a standard for measuring the performance of a company. Eventually, Budgeting can provide an in-depth understanding of money spends.įurthermore, It reduces debt troubles by thorough planning and well execution of budgets. Thus, Budget is one of the most important administrative tools for managing finances. Budget assists in controlling the actual costs. Importance of Budgetingīudgeting is a very important part of the company’s financial well-being. Moreover, it contains a summary of intended expenditures. In other words, a budget is the allocated amount for a particular purpose. It includes estimated sales volumes and other revenues, expenses, and cash flows.

Budget Template (Excel, Google Sheets, OpenOffice).

0 kommentar(er)

0 kommentar(er)